Under the bipartisan budget act of 2018 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems.

Energy star 2018 tax credits.

These instructions like the 2018 form 5695 rev.

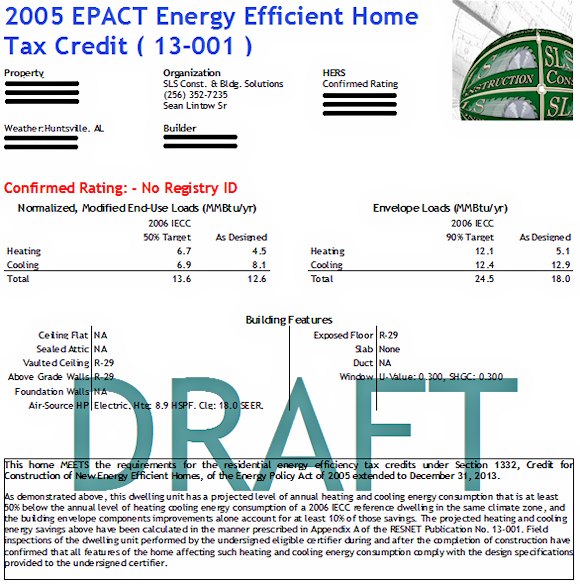

A tax deduction of up to 1 80 per square foot is available to owners or designers of commercial buildings or systems that save at least 50 of the heating and cooling energy as compared to ashrae standard 90 1 2007 or 90 1 2001 for buildings or systems placed in service before january 1 2018.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Claim the credits by filing form 5695 with your tax return.

The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 and 2019 on december 20 2019 as part of the further consolidated appropriations act.

Federal income tax credits and other incentives for energy efficiency.

Certified roof products reflect more of the sun s rays which can lower roof surface temperature by up to 100f decreasing the amount of heat transferred into your home.

This tax credit has unfortunately expired but you can still claim it for tax years prior to 2018 if you haven t filed yet or if you go back and amend a previous year s tax return.

Federal income tax credits and other incentives for energy efficiency.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

For more information see.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

This tax credit is for energy star certified metal and asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain.

30 for systems placed in service by 12 31 2019.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Renewable energy tax credits.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Use these revised instructions with the 2018 form 5695 rev.

The consolidated appropriations act 2018 extended the credit through december 2017.

The tax credit is available for homes built manufactured in the united states between january 1 2018 and december 31 2020.

Please note that with the exception of the tax credit for an energy star certified manufactured home these tax credits are not directly linked to energy star certification.