The annual entitlement is usually divided by 12 and issued monthly as part of the ontario trillium benefit otb payment see first three bullets of the note below for exceptions.

Energy efficiency tax credit canada.

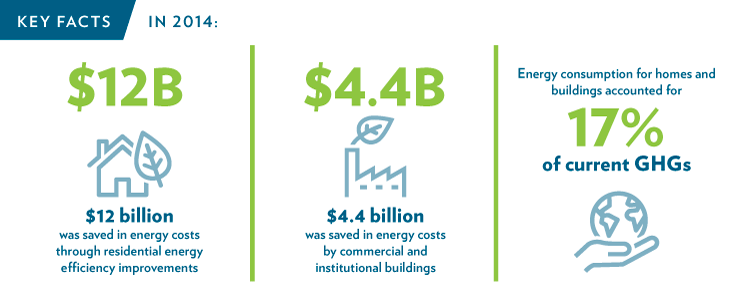

The energy savings rebate program makes energy efficient products more accessible to people across ontario.

Energy efficiency for homes.

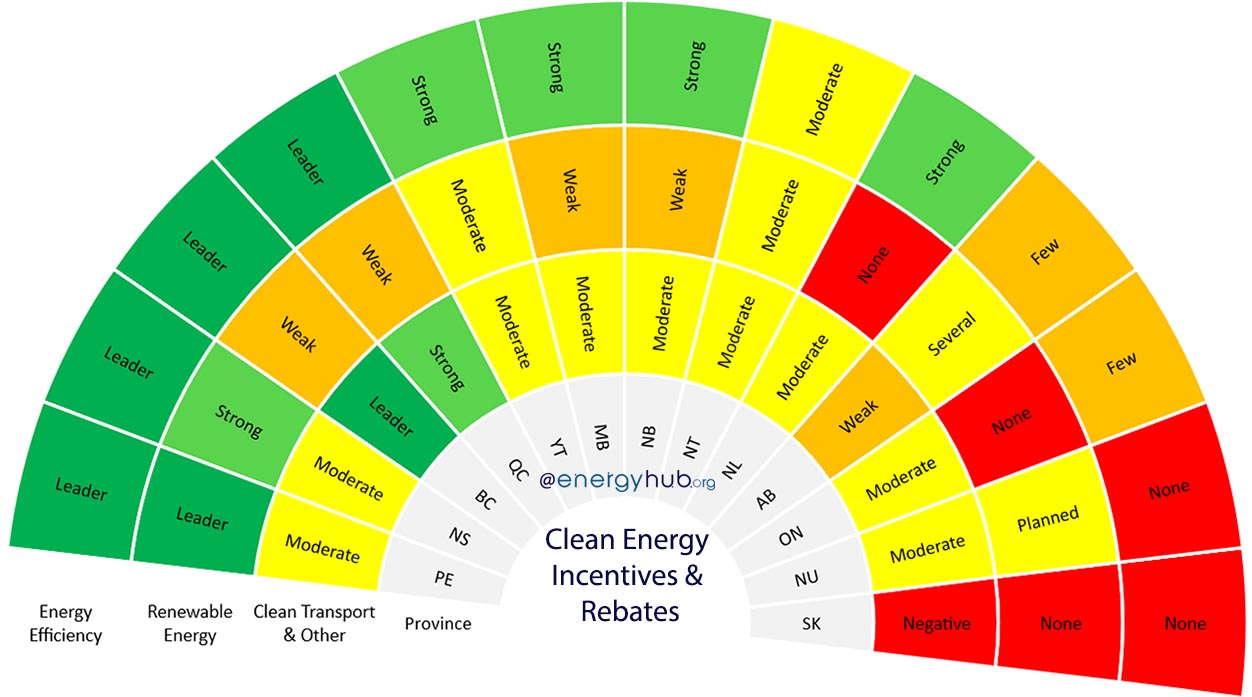

Select your province to see what financial incentives or programs are available.

To verify tax credit eligibility ask your hvac contractor to provide the manufacturer certification statement for the equipment you plan to purchase.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration.

Here are some of the best tax benefits rebates and grants you can get for renovating in canada.

A grouping of incentives related to energy efficiency from provincial territorial governments major canadian municipalities and major electric and gas.

The oeptc is designed to help low to moderate income ontario residents with the sales tax on energy and with property taxes.

Renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems.

The program provides 200 million over two years to participating retailers big and small to help ontario residents afford energy efficient products.

Of course renovations can be expensive but did you know that there are all kinds of programs that will help foot the bill.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Do not include the cost to install these items.

However the agency updates its website annually to reflect changes in credits and benefits and posts a comprehensive list of provincial and territorial government agencies who do provide rebates to homeowners.

30 for property placed in service after december 31 2016 and before january 1 2020.

26 for property placed in service after december 31 2019 and before january 1 2021.

Qualified improvements include adding insulation energy efficient exterior windows and doors and certain roofs.

You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

Central air conditioning cac air conditioners recognized as energy star most efficient meet the requirements for this tax credit.

The tax credits for residential renewable energy products are still available through december 31 2021.

The cra does not currently offer taxpayers any federal rebates for the purchase of energy efficient appliances.

Part of this credit is worth 10 percent of the cost of certain qualified energy saving items added to a taxpayer s main home last year.

Of that combined 500 limit a maximum of 200 can be for windows.

The residential renewable energy tax credit there are three applicable percentages you can claim.