Electricity duty is charged on consumption and is mostly a rate that is applicable per unit of electricity consumed.

Electricity duty act karnataka.

The karnataka taxation on consumption act 1959 provided the provision for levy of tax on consumed units of electricity.

So higher the number of units higher will be the electricity duty amount.

In exercise of the powers conferred by clause t of sub section 2 of section 181 read with sub section 1 of section 43 of the electricity act 2003 central act 36 of 2003 and all powers enabling it in that behalf the karnataka electricity.

For such of the units of electricity supplied by him the department of electrical inspectorate is collecting the tax on such of energy.

The karnataka electricity taxation on consumption or sale amendment act 2018.

Kerc recovery of expenditure for supply of electricity regulation 2004 kannada version.

Application of electricity duty or tax the duty is charged on consumption at the applicable rate per unit of electricity consumed.

Duty of the licensee to supply electricity on request regulations 2004 preamble.

Regulations on recovery of expenditure.

1 st amendment to kerc recovery of expenditure for supply of electricity regulations 2004 kannada version.

The only way to reduce the duty is to reduce the consumption per month.

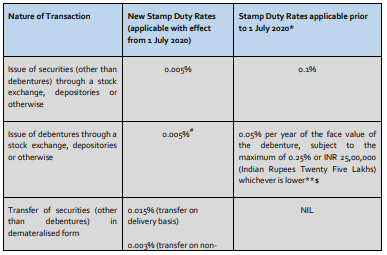

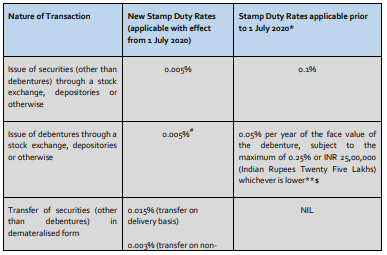

The new industrial policy provides for reimbursement of stamp duty and registration charges reimbursement of land conversion fee power tariff reimbursement and exemption from electricity duty.

Be it enacted by the legislature of the state of orissa in the twelfth year of the republic of india as follows.

An act to levy a duty on the consumption of electrical energy on the state of orissa.

Certain states the duty is charged on the total charges.

Short title extent and commencement.

Whereas the supplier has been authorized to collect the tax on behalf of the state govt.

Act 14 electricity taxation on consumption 155 taxation on consumption act 1959 to incorporate the consequential changes.

Electricity board recovery of dues act 1976 and the karnataka electricity 1959.

The central excise duty on electricity with effect from 1st october 1984.

The karnataka government s nip 2020 25 is a very forward looking policy which addresses several crucial labour reforms such as working shifts for.

2 nd amendment to kerc recovery of expenditure for supply of electricity regulations 2004.

In some states it is also applied as percentage of total charges electricity usage fixed charges and in some states both are applicable.

The karnataka electricity taxation on consumption or sale act 1959.